This one isn’t paranoia, unfortunately. According to Executive Order 13662, one of the companies listed is the primary Russian manufacturer of Saiga shotguns and new AK pattern rifles. Bearing Arms has a great breakdown on what this means for you.

The short version is that if you already own a gun manufactured by Kalashnikov, you’re fine. If everything’s paid for you’re in the clear and can sell it on the secondary market. That about covers the legal side of things. What we’re more interested in is the consumer side, because there’s a historical precedent here that makes it unlikely we’ll ever see these guns in the states again. The import restrictions on Chinese manufactured firearms are still in place, and there’s nothing that makes me think that even if the troubles with Russia were to completely blow over tomorrow that these import restrictions would be lifted.

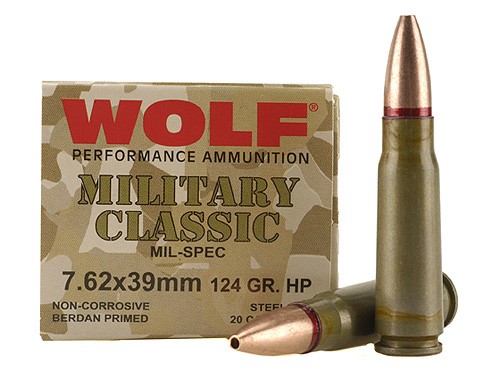

I actually share Tam’s concern even more: what about ammo? We are just now coming out of the ammo crisis to the point where 9mm is affordable and available again; I can buy 500 round bricks of .22 LR for 30 bucks, etc. I’d really hate to see the administration add Wolf and Tula to the list of companies subject to sanction. I like being able to buy a couple of boxes of cheap 9mm if I’ve miscounted what I need for a class or match. Needless to say, this is something that we’ll have to watch out for. Drying up the supply of cheap, steel cased rifle and pistol ammo would absolutely be a tough blow; and while it wouldn’t be the end of the world, I’m genuinely concerned that it could happen. I like having access to cheap steel cased 9mm for training; especially since I don’t reload.

still a couple available at http://www.gunwatcher.com

Tula is definitely on the sanction list. Batten down the hatches, we’re in for another round of panic buying.

Wish I knew where you find this “mystical” .22 for $30 a brick. It isn’t anywhere on the internet that I can find and the stores here in the People’s Republic of California either don’t have any or not in that quantity. And no, I refuse to pay $50 a brick. It’s gouging, plain & simple.

Uhh, if you can’t find it for $30 a brick, but it’s available for $50 a brick, that isn’t gouging. That’s market rate. I think the current market is outrageous and I hope it gets cheaper, but it’s still the market.

So when is it gouging? I’ve seen 22LR bricks for $95 at gun shows, if people buy it, that’s market . . . right?

Supply and demand: Prices send signals in BOTH directions.

If prices are too high, people won’t buy. As prices come down, people start buying: if they come down too far, people buy more than they need to satisfy their immediate need, which generally results in supply shortfalls.

If prices are significantly above average, but people are still buying, it sends the message that there is a supply shortfall, and that a lot of money could be made by an enterprising individual able to move significant amounts of Product X from Area A (where it’s cheap and plentiful) to Area B (where there is nowhere near enough supply, and desperate people are willing to pay far more than normal). Under normal circumstances, this produces a boom (as enterprising people rush to fill the demand) and a bust (once the demand is filled).

Think of it in terms of a post-storm market for bagged ice.

On day 2 of a massive power outage, the local supply of bagged ice is essentially depleted, and people are desperate for ice to keep their food cold. The local economy has no way to supply it (especially since the power is still out). Thus, the first guy who comes into town with a box truck full of bagged ice can (and should) charge $15-20 per bag: This encourages people to buy only what they need immediately. Once more people from the unaffected surrounding areas see that those in need are willing to pay $20 per bag of ice, the number of people filling up trucks with ice increases dramatically; Once they start getting to the storm-ravaged area, they realize that the supply/demand curve has changed; On day 3, they may only get $15 per bag, and on day 4 they may only get $12…. These price signals encourage people to meet the demand, and then finally send the signal that demand has receded. Since the signals lag in both directions, it causes a boom and a bust, which generally is best for everyone: not only does it ensure that demand is filled rapidly, but it also ensures that supply inflow drops as fast as possible.

The less we monkey with these forces, the better off we all are.

In all honesty, the REAL issue with the ammo market over the past ~18 months is twofold: First, many stores were unwilling to raise prices enough to send the right signals to their customers, and secondly, manufacturing capacity was not significantly increased.

If either/both of these factors had been substantially different (either higher prices, or higher supply), the ammo panic likely would have been much shorter. On the whole, if retailers had raised prices across the board sooner, we likely would not have seen an 18 month long panic: The panic has only been able to continue as long as it has due to prices being so artificially low.

Are you serious . . . people are panic buying because prices were too low? Wow, that’s far out man . . . . .

@Daniel:

The looming threat of legislation caused a massive spike in demand. The fact that prices didn’t spike soon enough to temper demand is why the supply shortfall is still a problem.

Think of it in these terms: If you needed ammunition in 9mm, how much would you buy (new, brass, boxer, NC) at $9 per box? How much at $25? How much at $50?

When prices are too low, it encourages people to buy more than they need in the short term, whereas when prices are higher, it encourages people to only buy a product if they truly need it.

The ammo drought we’ve witnessed over the last 18 months has only lasted as long as it has because overbuying has caused store shelves to be almost constantly empty, which in turn has shattered consumer confidence that they’ll be able to get what they need when they need it, which in turn leads to more overbuying.

This is a self-perpetuating feedback loop, which can only be broken in two ways: Higher prices, or higher supply. The ammunition manufacturers know this, and thus have been reluctant to significantly increase capacity, because increased supply would cause demand to fall below levels needed to justify the cost of additional equipment.

Thus, increased retail prices are the ONLY effective way to end this feedback loop.

King Obozo, safely ensconced in the New Harare White House, and his faithful sidekick, Attorney Gonoreal Eric Holdout are at it again. Is there no end to “His Ineptness’ ” treachery?

Quick, everyone run out and buy all the Wolf & Tula you can get your hands on. Your guns will love it and we’ll create another ammo bubble. Do it. Now.

Peter — I just bought a brick of Federal Champion .22LR for $34 at the gunshow three weeks ago. And I found BETTER deals after I had already spent my ammo budget for that show.

Was that a brick of 525 or 375 (or less); they’re making smaller ones now. Bottom line, the price has gone from 3.5 – 6 ¢ a round, to 10 – 13¢ round.